In the digital age, cryptocurrencies like Bitcoin, Ethereum, and Litecoin have changed the way people perceive money. Behind the scenes of this revolution lies a critical component: the crypto mining machine. These machines are the backbone of the blockchain, ensuring that transactions are verified and new coins are generated. If you’re curious about what a crypto mining machine is, how it works, and whether it’s worth investing in one, this guide is for you.

What is a Crypto Mining Machine?

A crypto mining machine is a specialized computer designed to solve complex mathematical puzzles that validate transactions on a blockchain network. This process is known as mining, and the machines that perform these computations are called miners. Unlike ordinary personal computers, mining machines are optimized for high performance and energy efficiency to maximize profits.

There are different types of mining machines, each suited to specific types of cryptocurrencies. The two most common types are:

- ASIC (Application-Specific Integrated Circuit) miners

- GPU (Graphics Processing Unit) miners

Each has its strengths, and the right choice depends on the coin you intend to mine and your budget.

How Does a Crypto Mining Machine Work?

Mining is the process through which cryptocurrency transactions are added to a blockchain. It involves verifying data, adding it to a distributed ledger, and solving a cryptographic puzzle. The first miner to solve the puzzle gets to add the next block to the chain and is rewarded with cryptocurrency.

Here’s a simplified breakdown of the mining process:

- Transaction Collection: Pending transactions are collected into a block.

- Hashing Function: The mining machine performs a cryptographic hash function on the block.

- Proof of Work: Miners must find a hash that meets a specific condition, which is resource-intensive and time-consuming.

- Block Addition: Once a valid hash is found, the block is added to the blockchain.

- Reward: The miner receives a reward in cryptocurrency for their effort.

This process requires significant computational power, which is why mining machines are built with high-performance components.

Types of Crypto Mining Machines

1. ASIC Miners

ASICs are machines built for a single purpose: mining a specific cryptocurrency. They offer superior performance and energy efficiency compared to other mining equipment.

Pros:

- Extremely efficient

- High hash rates

- Small physical footprint

Cons:

- Expensive

- Not versatile (designed for one type of algorithm)

- Hard to resell if the coin becomes unprofitable

2. GPU Miners

These are mining rigs built using high-end graphics cards. GPU miners are flexible and can mine multiple cryptocurrencies by changing the mining software and algorithm.

Pros:

- Versatile

- Easier to build or upgrade

- Better resale value

Cons:

- Lower hash rate compared to ASICs

- Higher power consumption

- Larger setup

3. CPU Miners

Once the standard for mining, CPUs are now largely obsolete for most cryptocurrencies due to their low processing power. However, some newer coins are designed to be CPU-mining friendly.

Factors to Consider Before Buying a Crypto Mining Machine

1. Profitability

The main goal of mining is to generate profit. Before investing, use online mining calculators to estimate potential earnings based on electricity cost, hash rate, and current market value of the cryptocurrency.

2. Electricity Costs

Mining consumes a significant amount of power. Electricity costs can drastically impact profitability, especially in regions with high energy rates.

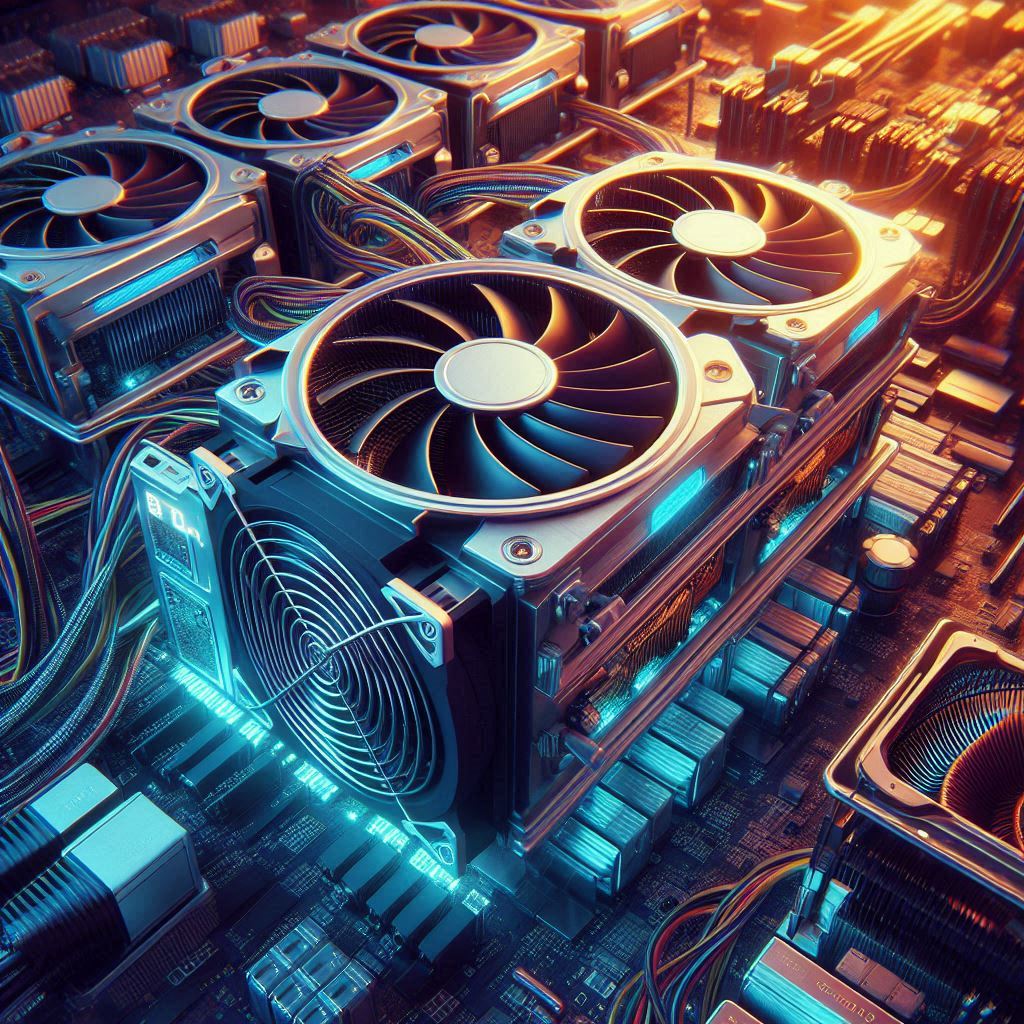

3. Cooling and Noise

Crypto mining machines generate a lot of heat and noise. Make sure your environment can handle the heat output and that you’re okay with the noise levels.

4. Upfront Investment

ASIC miners can cost thousands of dollars, while a decent GPU rig may be slightly cheaper. Factor in the initial investment along with potential ROI.

5. Maintenance and Durability

Like all machines, mining rigs require maintenance. Dust buildup, overheating, and wear and tear can reduce the lifespan of your machine.

Is Mining Still Profitable in 2025?

As of 2025, crypto mining can still be profitable, but it largely depends on several factors, including:

- The market price of the cryptocurrency

- The mining difficulty

- Electricity and hardware costs

- Access to efficient mining pools

With the halving events (especially in Bitcoin mining), rewards have decreased, making it essential to have the most efficient mining setup to remain profitable.

Alternatives to Buying a Mining Machine

If the investment in a mining rig seems too risky or expensive, consider these alternatives:

- Cloud Mining: Rent hashing power from a remote data center.

- Mining Pools: Join a group of miners who share resources and rewards.

- Staking: Some cryptocurrencies now use Proof of Stake (PoS), which allows users to earn rewards by holding coins in a wallet.

Conclusion

The world of crypto mining is both fascinating and complex. A crypto mining machine is a powerful tool that enables you to participate in the validation and security of blockchain networks while earning cryptocurrency rewards. However, it’s essential to do thorough research before investing in hardware, taking into account factors like profitability, energy costs, and machine type.

Leave a comment